News & Events

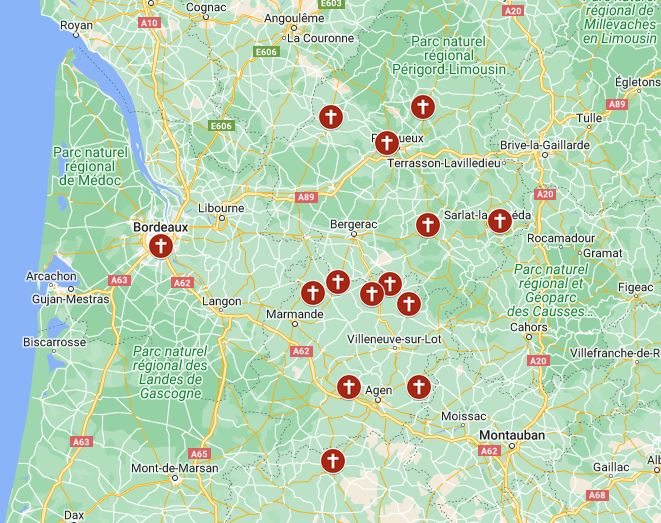

Dordogne

Gironde

Lot-et-Garonne / Gers

Information

Donations & Legacies

Grateful for online donations

We are grateful to those of you who have already taken steps to make regular or one-off donations to the Chaplaincy over the past years. As we come out of the pandemic, we are faced with a whole new set of challenges. It is likely to be a considerable time yet before we can hope that our financial situation will return to a more normal pattern and so we are still deeply reliant on your generosity and giving as part of your discipleship.

We will, therefore, continue to be particularly grateful if you feel able to make donations (one-off or regular) that might compensate for the loss of ‘plate giving’ and fund-raising events.

It is a great joy to be able to meet in person again, and we will continue to provide opportunities for various forms of worship, study, prayer and pastoral support online. Thank you for your commitment to the life of this wonderful Chaplaincy.

If you would like your donation to go towards a specific church/sector, please send an email to the Chaplaincy Administrator: chapaq.office@gmail.com.

Easy fundraising with online shopping!

Calling all online shoppers! Raise money for the Chaplaincy: If you shop online then there is a great opportunity to raise funds for the Chaplaincy without spending an extra penny yourself!

Sounds too good to be true? It isn’t if you shop online through easyfundraising.There are no catches and it’s completely free to use. It’s really simple – just shop online via easyfundraising.org.uk who have over 2,700 well known UK retailers like Amazon, Argos, M&S, eBay (and many more!) in their portfolio and whenever you buy something online, the retailer makes a donation to your chosen good cause.The Chaplaincy of Aquitaine has already been registered as a beneficiary.

All you have to do is select the Chaplaincy as your nominated charity when you shop. Get started now by clicking here.

Donating to the Chaplaincy and tax relief

Can you make a regular commitment? Would you like to make a donation? Please consider joining our Christian Stewardship scheme.

The Chaplaincy of Aquitaine will rely on the generosity and commitment of those who share in its life to raise around 170,000€ in 2017. This is needed to cover running costs including our full-time salaried Chaplain, communication costs and expenses claimed by volunteer helpers of which a number are Priests who give their services unpaid but may claim travel and other expenses.

We do not receive income from the Church of England (in fact we contribute to support our Bishop and his staff) and we do not have any endowments. We wish to encourage those who support us to enter into a commitment to give regularly. It helps us to plan our activities to know how much income we can expect. At the moment much of our income is in the form of cash given in the collection plate during services. We are grateful for and reliant on this giving.

If you would like to support us in a committed regular way please consider joining our Christian Stewardship scheme. It may also be that this could be tax efficient.

UK tax payers can Gift Aid donations through the Intercontinental Church Society. The relief which is smaller than under the French system is given to the chaplaincy. Higher rate tax payers will get extra relief when they declare their donations to all charities on their UK tax return. One off donations can also be made in this way.

If you are tax resident in France and are liable to pay tax on your income and are happy to give to the church by cheque or standing order, every euro you give will entitles you to 66 centimes of tax relief. In your tax assessment 66% of all donations up to 20% of your gross income will be deducted from the final tax due.

A regular donation of 10 € a week could cost only 176.80 € a year instead of 520 €.

If you would like to support us in either of these ways please speak to your local treasurer, warden, or contact : chapaq.office@gmail.com (06 07 04 07 77).

Leaving a Legacy to the Chaplaincy of Aquitaine

Many of you will be supporting various charities, both in France and in the UK. It is clear that charities are actively encouraging giving by legacy, and legacies are becoming an important part of the financial structure of many of these organisations. (See any of their websites.) This method of financial support is something that we should consider in relation to our own Chaplaincy. If people can be encouraged to give in this way, what a difference it would make to the Anglican Church here.

We may not wish to consider our own mortality, but it is a fact, and as Christians we can think about demonstrating our faith and our gratitude, by donating for the future of the Church after we have gone.

The Chaplaincy of Aquitaine is thriving, but with God’s help we need to ensure the future growth of the work that is going on here. There are already exciting ideas for building on what has already been achieved. For example, we would welcome a second stipendiary priest, to share the growing workload, and to ensure greater growth. This will cost us money. We are looking at ways that will make this a real possibility, and will also ensure our future. One contributing factor could be to promote the idea of giving by legacy.

Firstly we would encourage you to see an interesting article on the Costa Blanca website (below).

French residents are subject to French law. But once one has met the needs of one’s family, 25% of your estate can be left to anyone you choose. There is an exemption of tax for giving to “Associations and Congregations”. We can supply the rules of this exemption in French, for anyone who wishes to have it.

UK taxpayers can leave a legacy to ICS, and there is no inheritance tax to pay. You may be in a position where it is worthwhile considering this, and there is advice on the ICS website about the wording that can be used in your UK will.

In every case, if you are considering leaving a donation to the Chaplaincy, either money or property, it is essential to consult your own notaire/lawyer for specific advice on the wording in your will. In all cases the donation should be designated for the general use of the Chaplaincy of Aquitaine.